Taxes: 20% of GDP, regardless of actual tax rate?

by Vinay Gupta • May 21, 2008 • The Global Picture • 0 Comments

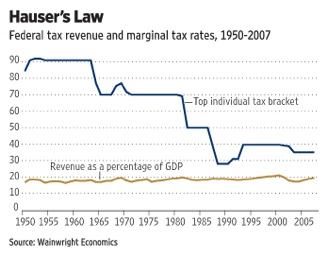

Mr. Hauser uncovered the means to answer these questions definitively. On this page in 1993, he stated that “No matter what the tax rates have been, in postwar America tax revenues have remained at about 19.5% of GDP.” What a pity that his discovery has not been more widely disseminated.

The chart nearby, updating the evidence to 2007, confirms Hauser’s Law. The federal tax “yield” (revenues divided by GDP) has remained close to 19.5%, even as the top tax bracket was brought down from 91% to the present 35%. This is what scientists call an “independence theorem,” and it cuts the Gordian Knot of tax policy debate.

Still thinking about the implications here. Why 20%? What’s actually going on here?